Longer Amortizations: Some banks conclude that a 30-year amortizing loan has a 10-year longer amortization period than a 20-year amortizing loan, or 50% more amortization life. On the surface, and semantically, that is correct, but also utterly meaningless. While borrowers always have the option to reduce debt, borrowers also have other uses for cash that do not benefit creditors and, most unfortunately for banks, weaker borrowers are less likely to pay down debt because of liquidity concerns.Ĭonsidering the output in greater detail uncovers some nuanced and germane conclusions that bankers should consider: The product is perfect for either quality borrowers that want loans with a longer average life than the bank feels comfortable making or borrowers with riskier profiles.

#Cash sweep free

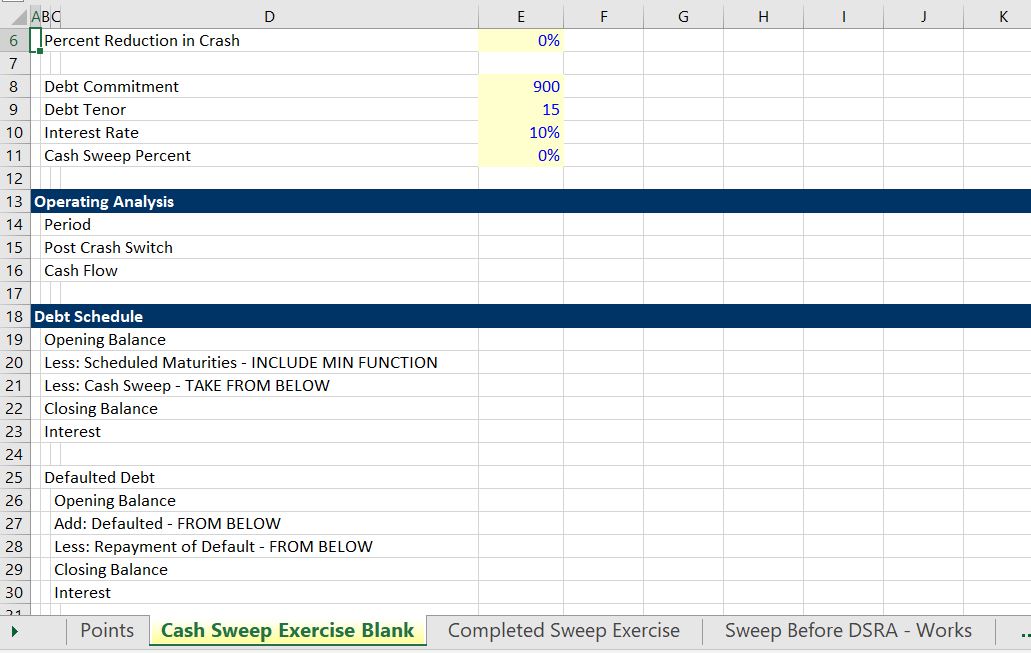

In fact, a cash sweep can be the biggest credit enhancement available to lenders for real estate secured transactions.Ī loan cash sweep is a mandatory reduction of debt based on a borrower’s free cash flow.

Further, the product can also enhance deposit performance, increase interest rate risk performance on fixed-rate loans and reduce the cost for the bank all while helping your commercial customer.

A properly structured cash sweep provision on a term loan can significantly reduce credit risk and turn a mediocre credit into a stable one. In this article, we look at an equally overlooked derivation of the product where excess operating funds are used to pay down a term facility instead of balances on a revolving line of credit. In the past, we talked about the fees, profit and risk profile of why banks should utilize an automated loan sweep (ALS) that moves excess funds to pay down the outstanding balance on revolving line of credit ( HERE).

0 kommentar(er)

0 kommentar(er)